Jarrod

Rutledge, CFP®

Founding Partner of Provident Wealth Management Group.

Read More...

Life in a Box

See how eMoney Advisor can help

organize your financial life!

Click play above to watch the video!

Jason

Heinzelmann, CRPC®

Founding Partner of Provident Wealth Management Group.

Read More...

WEALTH MANAGEMENT SERVICES

Products & Services

Planning & Advisory Services

Create a lasting legacy.

It is important to coordinate all

aspects of your finances to help

accomplish your highest purpose.

Investing

Invest in what matters.

We believe there is wisdom in systematically

saving over a period of time using

a disciplined investment strategy.

Insurance

Protect what’s important.

We believe that purchasing appropriate

insurance doesn’t demonstrate a lack of

faith but rather prudent planning.

Helpful Content

Understanding Homeowners Insurance

Purchasing homeowners insurance is critical for protecting your home.

How Insurance Deductibles Work

Knowing how insurance deductibles work can help you save money.

Variable Universal Life Insurance

Variable Universal Life is permanent insurance in which the policyholder directs how premiums are invested.

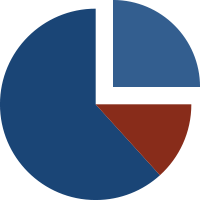

Asset Allocation

Consider how your assets are allocated and if that allocation is consistent with your time frame and risk tolerance.

Choosing a Retirement Plan that Fits Your Business

To choose a plan, it’s important to ask yourself four key questions.

Protecting Your Home Against Flood Loss

Protect yourself against the damage that your homeowners policy doesn’t cover.

Four Really Good Reasons to Invest

There are four very good reasons to start investing. Do you know what they are?

How Women Can Prepare For Retirement

Are women prepared for a 20-year retirement?

Dog Bites Neighbor. Now What?

Even dogs have bad days. So, what happens when your dog bites a neighbor or passing pedestrian?

View all articles

Interested in a Fuel Efficient Car?

Estimate how many months it may take to recover the out-of-pocket costs when buying a more efficient vehicle.

What Is My Current Cash Flow?

Assess whether you are running “in the black” or “in the red” each month.

Saving for Retirement

This calculator can help you estimate how much you may need to save for retirement.

Long-Term-Care Needs

Determine your potential long-term care needs and how long your current assets might last.

Paying Off a Credit Card

Enter various payment options and determine how long it may take to pay off a credit card.

How Compound Interest Works

Use this calculator to better see the potential impact of compound interest on an asset.

View all calculators

When Special Care Is Needed: The Special Needs Trust

A special needs trust helps care for a special needs child when you’re gone.

Bull and Bear Go To Market

Learn about the difference between bulls and bears—markets, that is!

Where Is the Market Headed?

We all know the stock market can be unpredictable. We all want to know, “What’s next for the financial markets?”

The Facts About Income Tax

Millions faithfully file their 1040 forms each April. But some things about federal income taxes may surprise you.

Investments

You’ve made investments your whole life. Work with us to help make the most of them.

The Business Cycle

How will you weather the ups and downs of the business cycle?